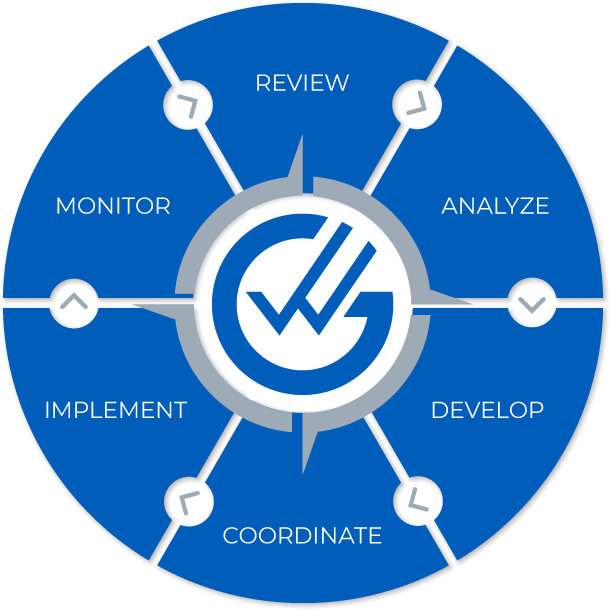

Our Process

One thing our clients appreciate about working with us is that we don’t believe in cookie-cutter solutions or a one-size-fits-all approach. Instead, we follow a meticulous process designed to help us get to know each client’s situation, goals, and level of risk tolerance so that we can make appropriate recommendations to meet their needs. Everyone is different, and we amend our approach to suit each specific client, but in general, we utilize the following process to help those we’re privileged to serve.

Step 1: Review

Together, we review your individual situation and personal objectives. Every family's financial situation is unique. That's why it's so important to find out as much as we can about you and your financial goals. The more we know about you, the more precise recommendations we can make and the more we can help you. We will take time to discuss your hopes, dreams, and objectives, the things that really matter to you and the things that keep you awake at night.

Step 2: Analyze

Next, we analyze the information we have collected and work with you to identify and prioritize your objectives, and then help establish benchmark goals. This is important because we live in a world of unlimited choices. By breaking down your goals into specific objectives, we can look at available resources and decide which goals are realistic, and which could be adjusted or scaled down.

Step 3: Develop

Based on our conversation and analysis, we developed a strategy to help you achieve your goals. We identify areas that need to be addressed and recommend steps to help you achieve your financial goals. Based on your needs, our recommendations will include Investment Planning, Retirement Planning, Protection Planning, and Estate Planning. For some clients, Business Planning is also needed.

Step 4: Coordinate

We regularly coordinate financial activities for clients with their own team of professional investment, insurance, tax or legal advisors. We can do the same for you or recommend advisors that we have found to be reliable and trustworthy.

Step 5: Implement

We'll help you implement your strategy, and work closely with you and your other third-party professionals to ensure its success. Some implementation steps include updating or completing your Estate Planning, adjusting your investments to better meet your risk tolerance and reflect your current financial status, applying for insurance to protect assets that you have indicated are important to your future success, deciding when to retire or start receiving Social Security Benefits, etc.

Step 6: Monitor

This is not a one-shot deal. Strategies need to be adjusted periodically as your life, and the economy changes. We'll monitor progress and provide ongoing service as your needs and situation change. We will work with you to help keep your strategy on track with our changing world.

|